Table of Content

Lastly, ICICI Bank Home Loans are linked to the central scheme of Pradhan Mantri Awas Yojana or PMAY, which provides eligible clients a Credit Linked Scheme or CLSS with additional benefits. For projects that ICICI Bank approves, approval and disbursement of the loan are faster and can be done with less documentation. If you have taken loan of INR 50 Lac in last years you will easily save Rs Lac . If you have been looking for ways to save for your future, you can switch to the ICICI Bank Home Loan Balance Transfer option. This is a smart move, as it allows you to move your Home Loan outstanding balance to ICICI Bank at a repo rate linked attractive rate of interest. ICICI Bank understands your needs and has you covered with a gamut of completely digital solutions specially for you.

For all the Non-auto Debit Cases, there will be an additional 10 basis points premium will be charged. Explore a vast database of 40K+ ICICI Bank approved projects by leading developers, across 44 locations in India. With effect from November 20, 2022, new Mortgage Loan charges are being introduced.

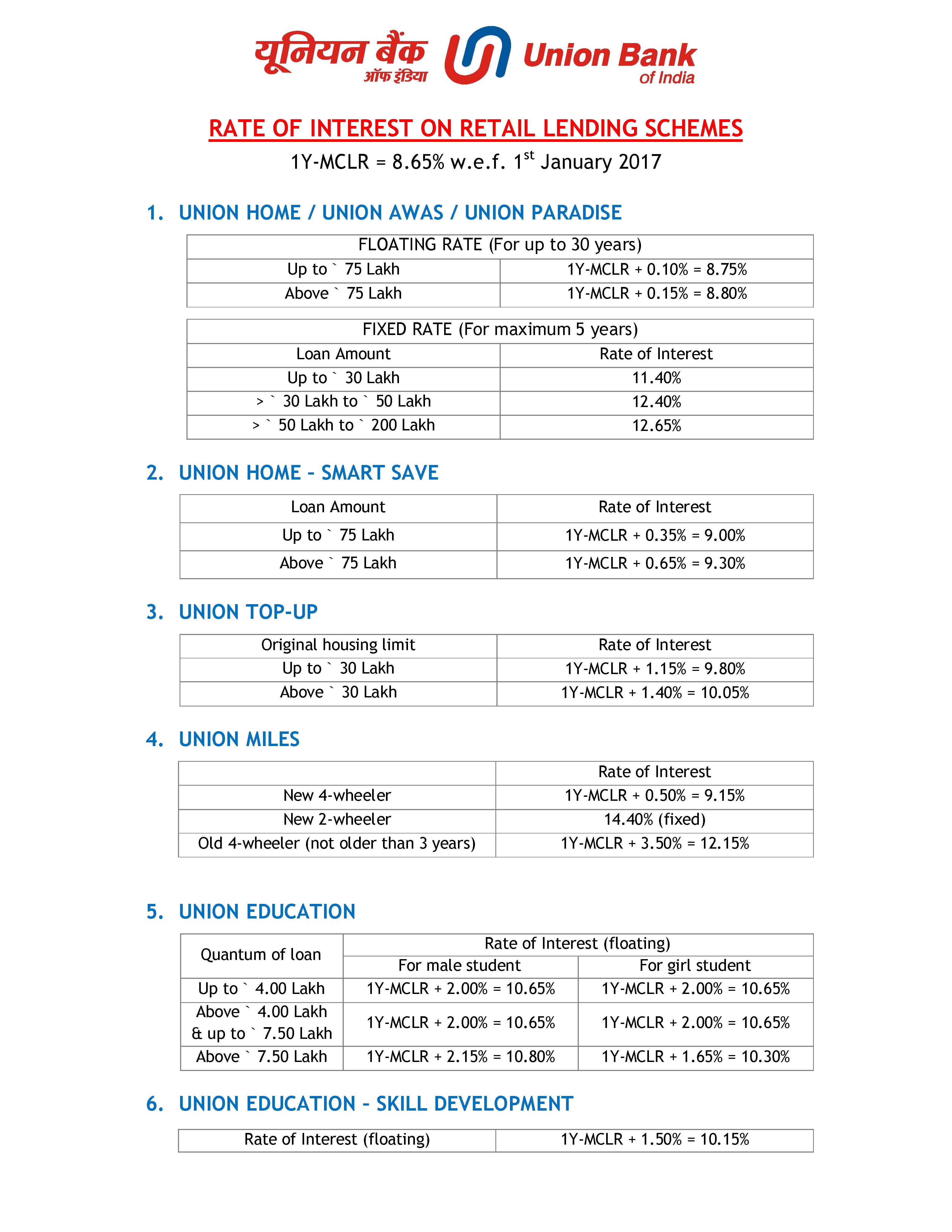

ICICI Bank Land Loan

The interest rate of ICICI home loans change at quarterly intervals i.e. on the first day of the calendar quarter when there is a change in RBI’s Repo Rate. For loan amounts more than INR 35 lakh and upto INR 75 lakh, with LTV below 70%, an additional 15 bps premium will be charged. For loan amounts upto INR 35 lakh and if Loan to value is below 80%, an additional 15 bps premium will be charged. For the loan amount upto INR 35 lakh and if they are Non-PSL, an additional 15 bps premium will be charged. Checkout the interest rates ranging from 8.40% - 9.45% on ICICI home loans.

ICICI HFC provides better interest rates to women to encourage them to apply as co-applicants. If you add your wife or mother to your home loan, you may be able to get a lower interest rate, even if they are not earning. We have a team of legal and technical experts at each of our 135+ ICICI HFC branches to guide you and review your application on the spot, so you avoid multiple visits and requests for documents. Our home loan helps both salaried individuals like government employees and corporate professionals, as well as self-employed individuals like doctors, lawyers, CAs, traders and small business owners. So whether you need a quick fix for an emergency or you’re planning ahead for longer-term financial needs, ICICI Bank has you covered.

Features and benefits

In fact, adding a woman as a co-applicant can help reduce your interest rate. In case your property has more than one owner, it is necessary that both or all the co-owners are co-applicants. Walk into yournearest ICICI HFCorICICI Bank branchto learn more about how to add a co-applicant and why from our team of experts. The rates, fees, as stated hereinabove, are subject to changes/ revision from time to time at the sole discretion of ICICI Home Finance Company. Our in-house experts will guide you through the benefits of each of the offers, so you can find an attractive deal.

However, if you have a home loan at a Fixed Rate of Interest then you will have to pay 4% on your principal amount and other applicable taxes. You can reduce the existing rate of interest of your Mortgage loan, by availing of our conversion option. By exercising this conversion option, you can either convert your existing margin to the applicable prevailing margin or you can switch from a floating rate to a fixed rate or vice versa.

IndusInd Bank Personal Loan Features and Benefits

Even if you don’t have formal income proof documents like ITR, but have a good history of repaying loans, our local experts will help you get the support you need. We offer easy eligibility norms and require very few and basic documents. You can get a home loan in as less as 72 hours as we have a team of legal and technical experts at each of our 135+ ICICI HFC branches who can review your application on the spot. Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances.

As a result, the EMI or the tenure of your loan will increase or decrease, depending on the change in the rate of interest. The interest on your home loan has to be paid on a monthly basis. You can choose the EMIs option, where you pay the same amount every month . Or, you can choose the SURF option or Step Up Repayment Facility, where your monthly payments increase over time, as your income increases.

1 books to read for Product Managers

They also have a wide range of loan products available, so you can find the one that is perfect for you. The bank also provides pre-approved, instant home loan approval for its account holders with salary and also a transfer of home loan balance facility for existing home loan borrowers from other lenders with lower rates. ICICI Bank Express Home loan offers online sanction of loan within 8 hours. ICICI Bank well known for its high eligibility & lower interest rates & sanction time.

The enhanced loan amount and the repayment tenure is backed by Mortgage Guarantee. An ICICI Bank Home Loan is a loan that you can take out to purchase or build a home. This type of loan is popular because it has low-interest rates and the repayment schedule is typically easy. This blog article offers a comprehensive look at the ICICI Bank Home Loan. It provides information about the loan’s interest rate, eligibility criteria, and more. Office Premises Loan - A self-employed businessman or professional needs a permanent address to set up his business.

This charge is expressed as a percentage on the principal amount, known as the interest rate. The interest rate on an ICICI home loan worth INR 1 crore can start from 8.40% p.a. However, the actual interest rate charged by the bank is influenced by numerous factors.

The penalty for early repayment of floating-rate loans is completely waived. ICICI Bank’s Home Loan is a complete solution for purchasing a dream home. Whether one wants to buy a house or build a new house, ICICI Bank provides a variety of home loan products that can satisfy those needs.

Pradhan Mantri Awas Yojana - ICICI Bank is pleased to offer "Credit Linked Subsidy Scheme" for EWS and LIG categories under Pradhan Mantri Awas Yojana. The scheme was announced by our honourable Prime Minister Narendra Modi and envisages the vision of housing for all by the year 2022. I/We hereby declare and affirm that the I/we have not made any payments in cash. Funds provided to an individual / entity for purchase construction extension or renovation of a residential property is called a Home Loan. ICICI Bank Home Loans come with a processing charge of 0.50%-2.00% of the loan amount or INR 1,500 . No, as per RBI guidelines, lending institutions cannot grant more than 90% of the property value as a home loan to the applicant.

I was skeptical at first, since it is generally not easy to get things done online in India. To my surprise, the entire home loan process was very quick and I had constant support and help from my relationship manager. I was briefed in detail about documentation, timeline and process. There was no over-promising of any sorts and he cleared all my doubts with patience. Being an NRI, I found it was really helpful having Krishna readily available to guide and support me with any queries. He was very professional in his conduct and proactive in answering my queries.

No comments:

Post a Comment